Legal Tech Spending Surges 9.7% as Firms Race to Adopt AI

Law firms with AI strategies are 3.9× more likely to see benefits as tech spending hits record growth, new report finds.

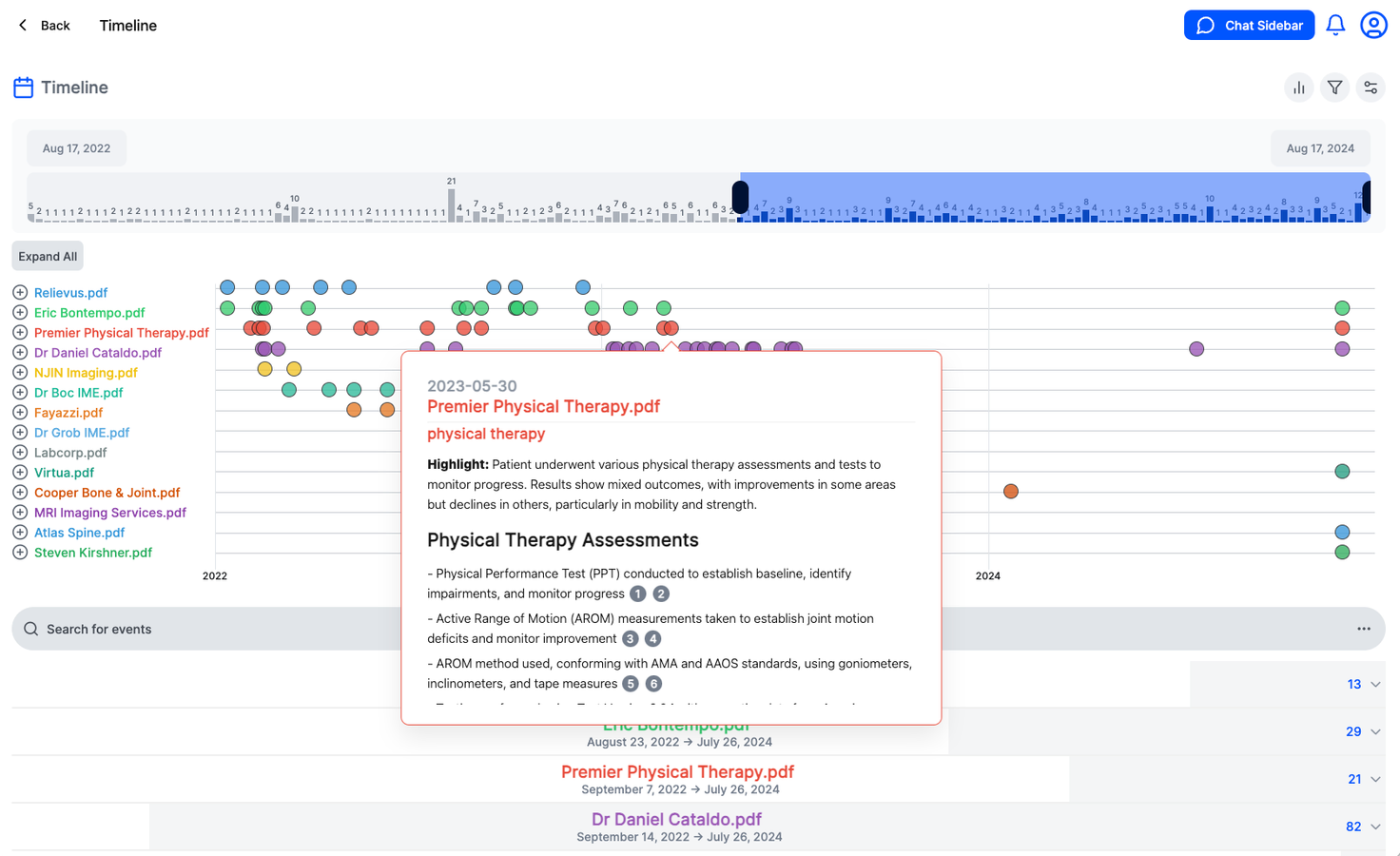

How artificial intelligence is transforming legal practice — from medical record analysis and OCR technology to case management integrations and AI-powered chronologies.

The legal industry is undergoing its most significant technological transformation in decades. Law firm technology spending grew 9.7% in 2025 — the fastest real growth the industry has likely ever experienced — and artificial intelligence is at the center of that investment. Firms with a formal AI strategy are 3.9 times more likely to report meaningful benefits compared to those without structured adoption plans. Meanwhile, 79% of legal professionals now report using AI tools in some capacity, up from just 19% in 2023.

This page provides an overview of where AI and legal technology stand today, the specific applications that are delivering measurable results, and where the industry is headed.

The legal industry's relationship with technology has historically been cautious. For years, surveys showed low adoption rates and skepticism about AI's applicability to legal work. That dynamic has shifted dramatically. The 2026 Thomson Reuters/Georgetown Law report documented a legal market experiencing what it termed "tectonic forces" — the convergence of technology investment, talent cost pressures, and shifting client expectations that is compelling firms to modernize.

Several factors are driving the acceleration. Generative AI tools reached a level of reliability that made them viable for professional use. Client pressure on legal fees intensified, creating demand for efficiency gains. And midsized firms demonstrated that technology adoption could be a competitive weapon — capturing nearly 5% demand growth in the second half of 2025 compared to under 2% for Am Law 100 firms, in part by using technology to deliver comparable work at lower rates.

The spending data confirms the trend: knowledge management tools grew 10.5% in 2025, outpacing even the overall technology budget increase. Firms are betting that AI-enhanced workflows are not a luxury but a requirement for remaining competitive. For the full analysis of spending trends, adoption rates, and competitive dynamics, read our report on legal tech spending in 2026.

Document review has long been one of the most labor-intensive — and expensive — activities in legal practice. In medical-legal cases, the challenge is particularly acute. A single plaintiff's medical history can span thousands of pages across dozens of providers, and the task of extracting relevant facts from that volume has traditionally fallen to paralegals creating manual chronologies.

The limitations of manual chronology creation are well-documented. It takes an average of 8 to 10 hours per case, and studies suggest that manual review misses approximately 37% of case-relevant details. The result is a process that is simultaneously slow, expensive, and incomplete.

AI-powered medical record analysis fundamentally changes this equation. Modern systems provide search capabilities across all records in a case file, allowing attorneys to query medical histories in plain language rather than reading page by page. AI co-pilots can answer questions about a patient's treatment history, identify inconsistencies, flag pre-existing conditions, and surface facts that manual review would likely miss — all with traceable citations that link every finding to its source document for verification.

The impact on firm economics is substantial. Firms using AI-powered analysis report a 90% reduction in time spent reviewing medical records, with better outcomes in terms of information completeness. For a detailed comparison of traditional chronology methods versus AI-powered analysis, including specific use cases and workflow examples, see our analysis of AI-powered medical record review.

Before any AI system can analyze a medical record, the document must be converted from its raw form — often a scanned PDF or faxed image — into machine-readable text. Optical character recognition (OCR) is the technology that enables this conversion, and its quality directly determines the accuracy of every downstream analysis.

Medical records present unique OCR challenges that standard commercial tools struggle with. Handwritten physician notes, stamped annotations, multi-column layouts, form fields with inconsistent formatting, and low-resolution fax artifacts all reduce recognition accuracy. Poor OCR output cascades through the entire analysis pipeline: if the text extraction misreads a medication dosage, a date of service, or a diagnosis code, every analysis built on that text inherits the error.

Advanced OCR systems designed specifically for medical documents address these challenges through specialized models trained on healthcare documentation. These systems achieve higher accuracy on handwritten notes, properly handle the structural complexity of medical forms, and incorporate medical terminology dictionaries to resolve ambiguous character recognition.

The quality gap between general-purpose and medical-specific OCR is not marginal — it is the difference between a usable analysis and one riddled with errors that require manual correction. For a technical overview of how advanced OCR works for medical records and why it matters for legal applications, read our guide to medical OCR technology.

AI tools and retrieval platforms deliver the most value when they are embedded in the systems attorneys already use to manage their cases. The legal technology market has increasingly recognized this, and integrations between retrieval services, document analysis platforms, and case management systems have become a key differentiator.

The practical benefit is straightforward: instead of logging into a separate platform, downloading records, and manually uploading them to a case management system, integrated workflows push records, analysis outputs, and status updates directly into the firm's existing tools. This eliminates duplicate data entry, reduces the risk of records being misfiled or overlooked, and gives attorneys a single source of truth for case information.

For firms using Litify — a Salesforce-based legal case management platform — direct integrations can automate the entire workflow from record request to organized case file. Records are requested, tracked, delivered, and indexed within the same system where attorneys manage their cases, eliminating the friction that comes from juggling multiple platforms. For details on how this works in practice, see our overview of the LlamaLab-Litify integration.

Legal technology conferences have become important barometers for where the industry is heading. These events bring together vendors, firm leaders, and technology officers to discuss what is working, what is not, and where investment is flowing. The themes that emerge from these gatherings often signal the priorities that will shape the market over the following 12 to 18 months.

Recent events have highlighted several consistent themes. First, AI adoption is moving beyond experimentation into production deployment — firms are past the pilot phase and are now focused on measuring ROI. Second, integration is becoming as important as capability — tools that do not connect to existing workflows see lower adoption regardless of their technical merit. Third, the conversation has shifted from whether AI will transform legal work to how quickly firms can capture the efficiency gains before their competitors do.

For specific insights from the most recent major legal technology gathering, including trends, notable announcements, and implications for firms evaluating their technology strategy, read our takeaways from LitiQuest 2026.

AI-powered document analysis and retrieval automation represent just one segment of a broader legal technology ecosystem that continues to expand. The landscape includes practice management platforms, e-discovery tools, contract analysis systems, legal research databases, client intake automation, and billing and financial management software. Each category has seen AI capabilities added or enhanced over the past two years.

What distinguishes the current moment is the degree to which these categories are converging. Practice management systems now incorporate AI-powered analytics. E-discovery platforms offer integrated document review. Retrieval services provide analysis and case management integration. The boundaries between categories are blurring, and firms increasingly evaluate technology as an integrated stack rather than as individual point solutions.

Understanding the full landscape — including where different tools overlap, where gaps exist, and how to build a coherent technology strategy — is essential for firms making investment decisions. For a comprehensive overview of the legal technology ecosystem and how its various components fit together, see our legal tech overview.

The trajectory of AI in legal practice points toward deeper integration, greater specialization, and measurable productivity gains. Several trends are shaping the near-term future.

Vertical specialization is accelerating. General-purpose AI tools are giving way to systems purpose-built for specific legal workflows. Medical record analysis, mass tort case management, and personal injury case evaluation each have distinct requirements that generic tools cannot fully address. The firms and vendors building specialized solutions for these workflows are seeing faster adoption and stronger results than those relying on horizontal platforms.

Automation is expanding beyond document review. The first wave of legal AI focused primarily on reviewing and summarizing documents. The next wave is automating broader workflows — from client intake and provider discovery through record retrieval, analysis, demand generation, and settlement submission. End-to-end automation across the case lifecycle promises to compress timelines and reduce costs at every stage.

Data-driven case valuation is becoming standard. As AI systems analyze more cases, they accumulate data on outcomes, settlement ranges, and the documentation patterns that correlate with higher valuations. This data is beginning to inform case strategy decisions — helping firms identify which cases to invest in, which require additional evidence development, and where to focus resources for maximum return.

Interoperability is a rising priority. Firms are pushing vendors to support open standards, API-based integrations, and data portability. The era of closed ecosystems that lock firms into a single vendor's toolset is ending. Firms want the flexibility to combine best-in-class tools across their workflow, and the market is responding.

The common thread across these trends is that legal AI is moving from novelty to infrastructure. It is becoming embedded in how firms operate, not layered on top as an optional enhancement. Firms that approach AI strategically — with clear objectives, measured outcomes, and integrated workflows — are the ones capturing the efficiency gains that are reshaping the competitive landscape of legal practice.

Deep dives and guides on ai and legal technology

Law firms with AI strategies are 3.9× more likely to see benefits as tech spending hits record growth, new report finds.

Discover why traditional paralegal-created medical chronologies are becoming obsolete as AI-powered search, intelligent co-pilots, and traceable citations revolutionize how attorneys analyze medical records.

Discover how our patented OCR technology achieves industry-leading accuracy in processing medical records, including handwritten notes and complex layouts.

New integration eliminates duplicate data entry—client demographics flow directly from Litify to LlamaLab, with records auto-filed to the correct matter.

Discover the latest legal technology trends and how they're revolutionizing law firm operations, client service, and case management.

300 plaintiff firm leaders in one room. The uncomfortable truth? Most are still thinking about AI wrong. Takeaways from LitiQuest 2026.